Dealing with property damage is hard enough. But when your homeowners insurance claim gets denied, it can feel like you’re being left to fend for yourself. Whether you’re facing storm damage, fire loss, or some other major setback, a denied claim can delay your recovery and leave you unsure of what to do next.

If you’ve recently received a homeowners insurance claim denial in Oklahoma, you’re not alone—and you do have options. At 222 Injury Lawyers, we’ve helped many families understand their rights and take meaningful steps to challenge insurance companies that fail to hold up their end of the deal.

In this blog, we’ll walk you through what a denial means, why it may have happened, and what actions you can take to fight back.

Understanding the Basics of a Homeowners Insurance Claim Denial

When you file a claim with your insurance provider after your home suffers damage, you expect that your policy will cover the costs—after all, that’s what insurance is for.

But when the insurance company comes back with a denial, it means they’ve decided not to pay for the damages you’ve reported. This can be a full denial or a partial one where they offer less compensation than you believe you’re entitled to.

These denials can happen for several reasons, and while some may be valid, others are not. Knowing the difference is the first step in figuring out what to do next.

Common Reasons Insurance Claims Get Denied in Oklahoma

Here are some of the most common reasons an insurance company might give for denying a homeowners claim:

- Damage Not Covered by the Policy: Some policies have exclusions for things like flood or earthquake damage. If the damage doesn’t fall under your coverage, the insurer may deny your claim.

- Lapsed Coverage or Missed Payments: If your policy wasn’t active when the damage occurred, the insurer might reject your claim.

- Alleged Misrepresentation: The insurance company might claim you provided false or incomplete information during your claim or when you purchased the policy.

- Late Filing: Most insurance policies require you to file a claim within a certain time frame. If you miss the deadline, they may deny it.

- Insufficient Evidence or Documentation: If you didn’t provide enough detail about the damage, the insurance company may argue that they don’t have enough to justify paying out.

In some cases, insurance companies may also act in bad faith—delaying responses, making unreasonable demands for documentation, or denying valid claims without a clear explanation.

Steps You Need to Take After a Homeowners Insurance Claim Denial

If your claim has been denied, don’t panic. You have several ways to challenge that decision and potentially reverse it.

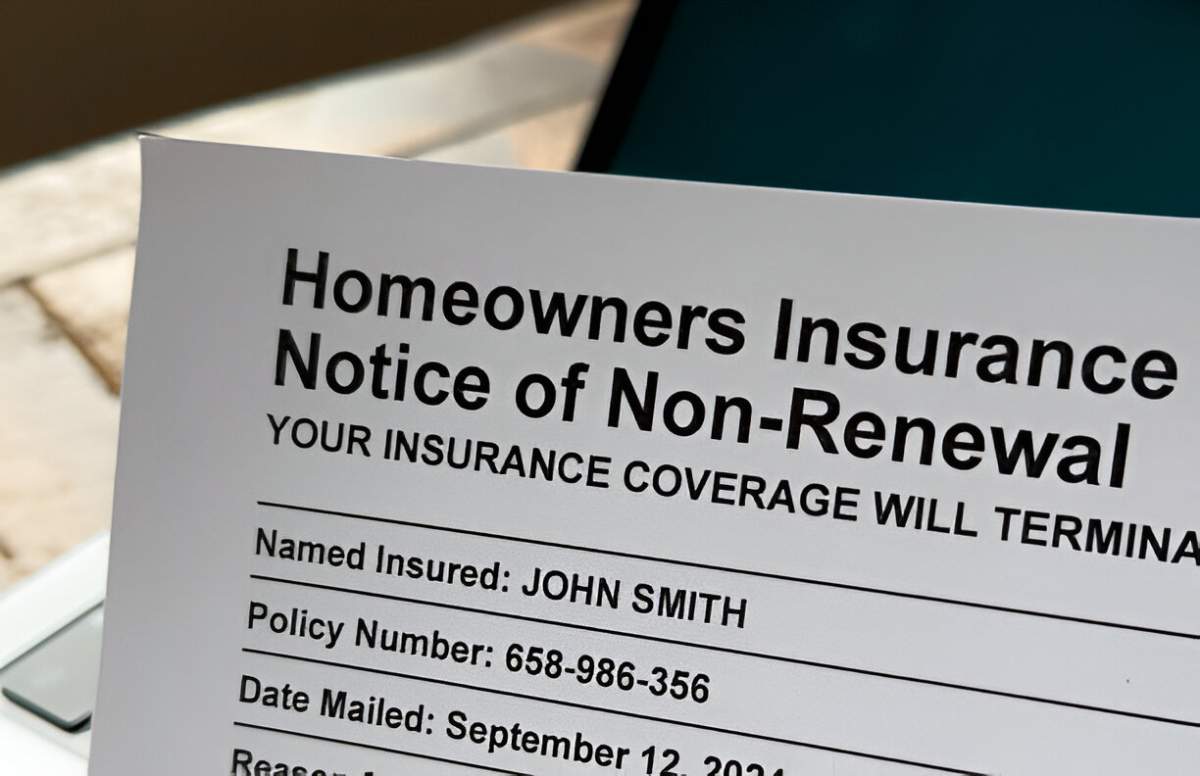

1. Review the Denial Letter Carefully

Start by reading the denial letter your insurance company sent. This letter should outline the reason for their decision. Understanding their explanation gives you the foundation to build your response.

If something doesn’t make sense, write it down, highlight it, and reach out to your adjuster for an explanation.

2. Request a Copy of Your Insurance Policy

Make sure you have a complete and up-to-date copy of your policy. Compare the denial explanation with your policy’s terms and conditions. Look at the sections regarding exclusions, limitations, and filing requirements.

Sometimes, what the insurance company claims isn’t supported by your policy at all.

3. Document Everything

If you haven’t already, gather all your documentation:

- Photos or videos of the damage

- Receipts for repairs or temporary lodging

- Communication with your insurer (emails, calls, letters)

- Estimates from contractors

Organizing your evidence will help you build a solid case if you need to appeal or pursue legal action.

4. File an Appeal

Most insurance companies offer an internal appeals process. You can formally dispute the decision by writing a letter and providing supporting evidence that the damage should be covered under your policy.

Keep your appeal clear, factual, and focused. Include:

- A summary of what happened

- A copy of the denial letter

- A clear explanation of why the denial is wrong

- Any photos, receipts, and reports that back up your claim

Don’t wait too long—there are deadlines for appealing, so act quickly.

When to Get Legal Help

If you’ve appealed and the insurance company still refuses to pay—or if you suspect they’re not treating you fairly—it may be time to speak with a lawyer.

We’ve seen how devastating a homeowners insurance claim denial can be, especially when the damage is significant. Many people assume they have no choice but to accept the denial. The truth is, you can challenge it.

We can help you:

- Review your policy to see if the denial was legitimate

- Communicate with your insurer on your behalf

- File a lawsuit if necessary to recover what you’re owed

- Push back against bad faith tactics used to avoid paying claims

Insurance companies are businesses, and they often prioritize profits over people. That’s why having someone in your corner who understands the law—and how these companies operate—can make all the difference.

What You Can Recover

If you’re successful in appealing or litigating your case, you may be able to recover:

- The full cost of repairs or replacement

- Additional living expenses (if your home was unlivable)

- Legal costs

- In some cases, extra damages if the insurer acted in bad faith

It’s important to remember: every situation is different. The amount you’re owed will depend on the specifics of your policy and the nature of the damage.

Don’t Give Up After a Denial

Getting your homeowners insurance claim denied isn’t the end of the road.Whether the insurer made an honest mistake or is acting in bad faith, you have a right to challenge a decision that leaves you financially vulnerable after a major loss.

By reviewing your policy, documenting your claim thoroughly, and appealing with strong evidence—or seeking help from a law firm that handles insurance disputes—you can get back on track and secure the support you paid for.

Let 222 Injury Lawyers Help You Move Forward

At 222 Injury Lawyers, we believe insurance companies should honor their promises. If your homeowners insurance claim denial is standing in the way of recovery, we’re here to guide you through the next steps.

We know how to handle these cases, and we’re committed to making sure Oklahoma families get the protection they deserve. Don’t wait—reach out today for a consultation and let’s talk about how we can help you fight back.

Leave a Comment